NEWS

U.S. Tariff Policy Changes Shift E-commerce Logistics to Europe

Release time:2025-02-17 17:10

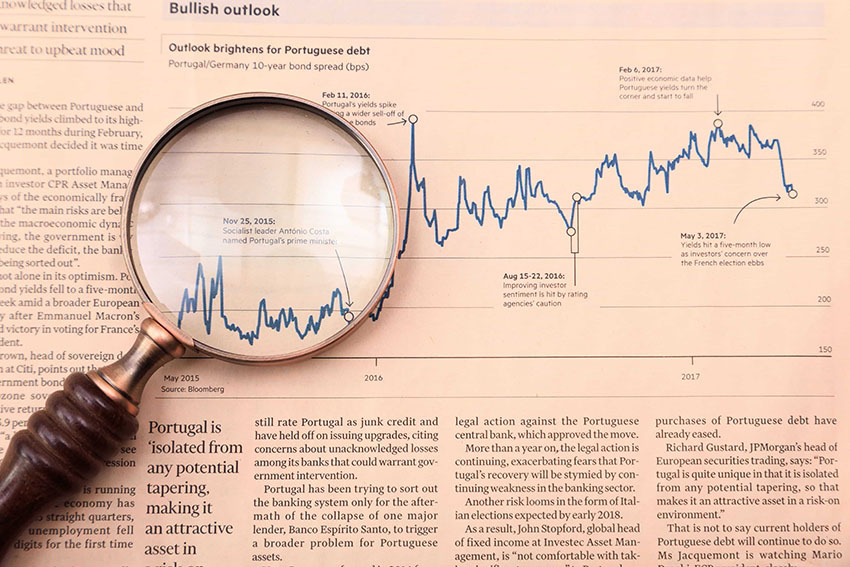

Recently, media reports have indicated that if the U.S. cancels its minimum customs duty exemption policy (i.e., the "duty-free allowance policy"), air cargo volume between China and the U.S. is expected to decrease significantly. Additionally, some air freight from Asia may shift to Europe. This policy change will have a profound impact on the global e-commerce supply chain, prompting e-commerce companies to rethink their shipping routes and potentially triggering a shift in production hubs.

If the policy is canceled, e-commerce companies will adjust their shipping routes. U.S. demand will decline, and some air freight could shift to Europe, which may become the next key market. Currently, there is still a significant amount of untapped shipping capacity on transpacific routes, and several European airports have become major hubs for e-commerce logistics. The European e-commerce market is also expanding. Therefore, future air freight demand in e-commerce may lean toward Europe.

As e-commerce companies adjust their shipping routes, they may also shift their supply chain focus to other regions such as Latin America, Africa, and Europe. This means that a substantial amount of air cargo capacity will flow to these emerging markets. With changes in U.S. tariff policies, the cross-border e-commerce supply chain is diversifying. Many manufacturers are moving their production lines from China to countries such as Brazil, Turkey, India, Vietnam, and Mexico, adopting nearshoring and reshoring strategies.

To adapt to these changes, e-commerce companies are making a series of adjustments, including storing major products in U.S. warehouses and using localized production to mitigate potential tariff impacts. These companies are also actively seeking U.S.-based manufacturers and sellers to sell products directly to U.S. consumers. As U.S. domestic shipping volumes increase, the need for air freight from China to the U.S. will decline, making the significant reduction in air cargo volume on China-U.S. routes inevitable.

The cancellation of the minimum customs duty exemption policy will not only affect Chinese e-commerce companies but will also impact many U.S. and European e-commerce businesses. These companies source products from China and ship goods directly to customers through Chinese logistics centers. The policy change forces these companies to reevaluate their supply chains, potentially shifting to domestic production or establishing logistics centers in North America, or even altering the country of origin of their products.

Although this policy change may lead to higher air freight costs between China and the U.S. and extend cargo processing times, many signed contracts will remain valid, meaning air cargo from China to the U.S. will continue.

RECOMMENDED ARTICLES

Feb 23,2024

Take a look! Starting from March 1, Amazon’s new storage capacity policy will be officially implemented.

Free Quote

Free Quote